Christmas trees are up and decorated, Christmas lights are on from last year or have been up since Halloween/Thanksgiving. Christmas carols are in stores and malls. “It’s thee most wonderful time of the YEAR!” (Remember that song?) Or should we sing “It’s thee most spending time of the YEAR!”

This is the holiday where we spend heaps of money on gift(s) and food for our co-workers, loved ones and Christmas gatherings. Normally it starts from Black Friday, where people will spend HOURS in line to get that first “deals”, willing to fight others to get that new technology (the things I saw on Instagram sadden me). All these things are great gesture spending time with your loved ones and making them feel appreciated. But are you digging yourself into more debt and struggling to get by?

Here are some facts

In Canada,

“In an annual survey, Canadians appear to be ready to spend in spite of lots of financial concerns about growing personal debt.

Ebates.ca says in its survey that on average Canadians will spend about $570. Parents will spend about $710 on average, while those without children will spend roughly $489.”

In the United States,

“World News with Diane Sawyer” is gearing up for a “Made in America Christmas” and we need your help. The average American will spend $700 on holiday gifts and goodies this year, totalling more than $465 billion, the National Retail Federation estimates.

In the UK,

“With such a high expenditure, how will families be able to deal with the financial pressure? Many people try to go into Christmas with an open mind, and 45 percent of people try to not set a budget allowing them to share selflessly with others.

Overall people in the UK spent 748 British pounds per person in the year 2016 for this beloved time of year with technology being the leading contributor to sales, amounting to 299 British pounds per person, nearly one third of the overall Christmas expenditure.”

So here are some tips for managing the holidays financially with your loved ones and still being able to survive the holidays afterwards!!

Here are a couple of financial tips for the holidays

- Set a “Holiday” budget

If you didn’t set a budget this year, it’s fine. Guess what?! I have shocking news for you, Christmas happens EVERY year. So why not start your budget earlier than normal, if you want you could start it a year earlier with my money challenge blog. This way you will be able to have a comfortable amount of money set aside for your loved ones.

- Holiday Pay or Extra Pay

Companies tend to offer their employees extra shifts or seasonal part-time positions may become available to earn some extra cash. Not sure who’s hiring? Try Craigslist, Kijiji, indeed.com or Google “seasonal part-time”. Or you can try out Upwork or Fiverr if you want to do freelancing.

If you are really strapped for cash here are some valuable tips

- Secret Santa

This is for the families that are either strapped for cash or have a large family. The basic concept of the Secret Santa game is simple. All of the participants’ names are placed into a hat, box, etc. and mixed up. Each person then chooses one name from the box but doesn’t tell anyone which name was picked. He/she is now responsible for buying a gift for the person selected. So choose a reasonable budget.

- Gifts under $50

This is for the individuals that feel downright guilty if they don’t get SOMETHING for their loved ones. I totally understand, but if you are strapped for cash these are one of the options that are best for you!!! There are plenty of gifts that are affordable.

For tech-savvy folks:

- Headphones

- VR headset

- Portable Charger Powerbank

- Bluetooth Wireless speaker

Check out Best Buy for some ideas (https://www.bestbuy.ca/en-CA/sc-23060/gifts-under-50)

For book savvy folks:

- Planners

- Cookbooks

- Fiction books

- DIY/Educational books

Check out Chapters for some ideas (https://www.chapters.indigo.ca/en-ca/gifts/shop-by-price/50-and-under/)

For children

- Toys

- Educational items

- Stocks; RESPs; Children’s Savings Account (Yes! Build wealth for your children)

- Clothes

Check out the options for buying your children – https://www.consumerreports.org/gift-giving/stock-as-a-gift-for-kids/

Other gift ideas under $50

Unique gifts- https://www.thegrommet.com/gifts/under-50

Uncommon but pratical gifts – https://www.uncommongoods.com/gifts/by-price/gifts-under-50

Amazon gifts – https://www.amazon.ca/s/ref=nb_sb_noss_1?url=search-alias%3Daps&field-keywords=gifts+under+50&rh=i%3Aaps%2Ck%3Agifts+under+50

Best find gifts – https://globalnews.ca/news/3884698/holiday-gifts-under-50/

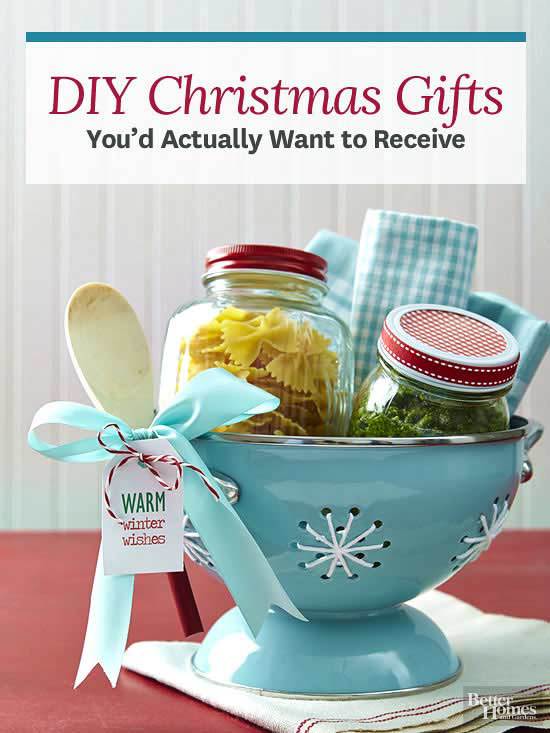

- Homemade gifts

To all the creative individuals that are strapped for cash but use their special talents and/or skills to make gifts. It can be baked goods, jam, salsa and drinks (does anyone want to gift me sorrel J ).It can be aromatherapy items, shea butter, candles and body scrubs. Gift baskets anyone?

Checkout inexpensive homemade gifts – https://www.iheartnaptime.net/handmade-christmas-gifts/

- Last minute gifts aka Lazy mode

This is for the individuals that are not sure what to give their family and friends (yes this happens) or indecisive about what to give them. Or simply on the last days of buying gifts aka last minute. I call this the lazy mode though; GET THEM THAT GIFT CARD!!! Whether it’s the store gifts card or simply giving them that prepaid card!!! I got y’all that want to be simple.

Check out the options of giftcards – https://www.giftcards.ca/

- Last resort option: Wait until after Christmas!!

I’m serious!!! If your family and friends REALLY understand then if you are not able to get a gift during Christmas, it’s not the end of the world! But let it be known, communication is key and you need to address your family and friends about not being able to provide a gift. If the other options I mentioned above aren’t feasible for you, then try this option. This is the last resort; the true meaning of Christmas is not which expensive gift did you give your loved ones but about spending time with your loved ones. (I can picture some of you guys rolling your eyes at me) For example, I had given my family printouts of the gifts that they wanted. Eventually I gave them the gift.

Like I said before, this holiday season should be about gathering with your family and friends. I for once learned not to expect materialistic gifts but more practical and from the heart!!! So I hope y’all enjoy the holidays and stay safe. Bless up!!