[mailerlite_form form_id=3]Welcome to the 2nd post (thanks for dropping by this second time around, I really missed you since the last time that we met each other).

So I’m sure if you looked on my Instagram, you would have noticed the Money Challenge post I suggested.

Beginning of this month I asked my family and friends if they wanted to do this challenge with me. Some were ready to roll, some were hesitant. Let’s be honest, in the next week or so (if you haven’t done it already), you will probably buy something that was a waste of money. Which is perfectly fine, (listen I wanted to treat myself to some chocolate the other day).

However, why aren’t you thinking of paying yourself first? So many times I’ve heard my friends tell me how lucky I am to have travelled around Asia. Umm, not really. I just….SAVED! And so can you!!

So here’s how it goes:

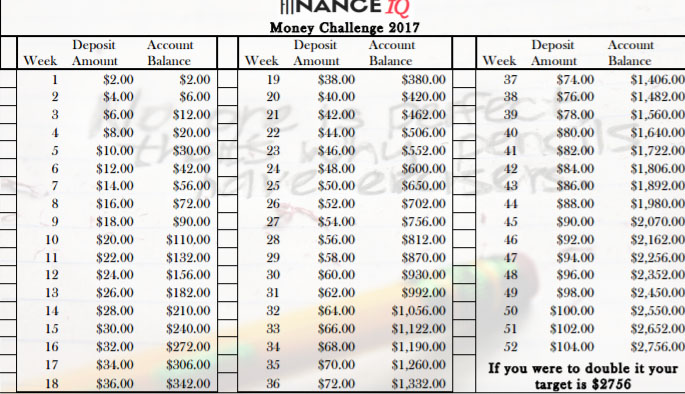

Week 1 (It’s past already I know), you will be depositing a dollar into your savings account. I suggest a savings account so you can build interest on it, (it may be a small amount but hey anything is better than nothing). Let’s jump to week 3, so by now you should be putting in 3 dollars and you should have 6 dollars in your account (1+2+3= 6). Pretty easy, right? Well if you REALLY like a challenge how about doubling up! You should have 2 dollars at week one and by week 3 you should be putting in six dollars, leaving you with a sum of 12 dollars in your account.

Getting a little overwhelmed?

Now I know some of you are worried around the months of October to December, heck even I am. But this is the reason I have suggested a certain amount that should be in your account by week 40 ( to keep you on track) and a check section at the beginning of the week. If you think you’re better off putting more at the beginning just in case, by all means go right ahead. As long as you’re paying yourself first!

After the year is up then what?

Good question! Well if you were able to commit to the year of saving you would have saved up $1,378 and if you doubled up you would have saved $2,756!!! My lord! That’s quite a good amount and can you imagine with the interest. So here’s an idea of what to do with it.

–KEEP IT IN YOUR SAVINGS. Why not just keep it in there and make it grow, do the same thing in the new year. You already committed, so keep at it. It will help you in the long run (down payment on a house, retirement, investments, etc).

–PAY OFF ANY DEBT. Have an outstanding balance on your credit cards, a line of credit, OSAP (student loans to the non-Canadians) or any other debt? Just pay it off!! You’ll feel better about yourself that you’re finally “adulting” a bit better.

– TREAT YOURSELF Or like my friends would say “treat yo self!” The year is over and you’ve worked hard at saving. You don’t have any major debt to pay off. Then go on that dream vacation that you’ve always wanted to go on. How about that outfit you’ve been eyeing or feeling sore and stress? Go to that nice spa. Reward yourself for committing to the year.

So let me know if you want to join the money challenge. I’ll send you a reminder every other week or every month to make sure you are still on track. Let’s shape up our finances! Til next time.

[mailerlite_form form_id=3]

I was so inspired to do this and I will do this at the beginning of February and I’ll get Morlon to do it as well. I love that you’ve decided to do this blog. Awesome job girl!

Pingback: Tips on Managing Christmas Holidays – FITNANCE IQ