Hey FitnanceIQ family, let me first apologize for the long delay of my review of my last week of June. Before I start this, I knew this week would have been tricky! I just did not think I would be over my budget this much. However please note the last week was approximately 9 days. So technically let’s prorate it from $30-50 to $38.57 – 64.29, now I feel much better discussing how my week went

- Went to football practice

- Attended and participated in the Spartan race

- Watched my football game (I had an ankle injury so I could not participate)

- Went grocery shopping with my parents

- Volunteered

- Did a bit of socializing family and friends

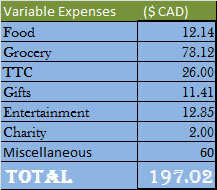

Let me show the table.

My my my! How did it get this bad! Well based on the prorated amount above I went over by $132.73 (instead of $147.02). It was quite tricky living within the $30-50 for the last week of June since my cash flow changed flow drastically to reflect a major increase. However, due to this, I was in a better position to play catch up on things (finances). The more money you make, the more you spend. So ideally when your cash flow increases you can either adjust your spending money according to you (that’s unless you are drowning in debt) or learn to tweak your discipline on spending. Remember this does not include my fixed cost (Rent, Phone, Internet/Utilities). Well here’s a rundown of the last week.

- So the beginning of the month I decided that I would get the discounted rate for the monthly metropass at work. But I would have to resort to getting the regular price for July. Because I felt like I wasted money with the weekly pass, I decided to switch to the Presto card which in my opinion was affordable or the same as purchasing tokens (but sometimes carrying tokens can be SO annoying!) Like I said previously I go from point A to Point B, so there was no point getting the weekly. GOOD NEWS though I was managed to get the discounted metropass for 130.25 (On average if I used it on only workdays it would be 6.20 a day) so looks like I will take advantage of July after all!!

- During that weekend I participated in the Spartan race before attending the event I knew there were a couple things to secure. A shirt of “FitnanceIQ” to promote myself while I do the challenge; and because it was at least an hour outside of Toronto I managed to get a ride from my brother to Clarington, Ontario so it is only right to pay for gas and parking. Long story short, I sprained my ankle during the race and took around 4 hours to complete it! The only way I knew to congratulate this challenge was buying some drinks.

- Now everyone knows I live at home with my family still, so my rent is pretty affordable for me. Once in a while I will contribute to getting groceries, this week was my time to pull out that cash. It is an ideal idea spending money to get food for the family!! Also, I invested in some trail mix, which helps me stay full and alert at work (I just need to learn self-control in not eating it all in one sitting).

- I still do my best to bring lunch to work and not spend (I manage to bring at LEAST 4 times a week). Now the tricky part is not buying breakfast! Even though the breakfast an come up to $2, you have to factor doing that 5 times a day (even though I do not) So $10 a week which comes up to $40-50 a month or $480-520 a year. That could have been put into my savings or pay off my debt. So sometimes we just need to prepare our BREAKFAST from the night before or wake earlier to eat.

- When budgeting you do not normally put the consideration of lending anyone money. Whether it $5 or even $100 or much more. Rule of thumb makes sure you can afford the money you are lending. I actually had two times when I was feeling exceedingly generous that I lent money to others and BOOM. It happened that I cheated myself as I ended up not having enough money to purchase the metropass because my hard earned money was not available to me. So in the ended up BORROWING money to cover the cost of my metropass. So as that lesson taught me, I will no longer provide loans unless I have over a certain amount to cushion any unexpected costs.

Let’s give ourselves a pat on the back guys, we did it!!. My total spending for the month of June came up to $386.73.

So I basically spent $96.68 per week, now that Caribana weekend has come and gone, my goal is to keep it consistent at $75-80 per week. As I mentioned I have increased my cash flow and I can adjust my budget to reflect the change. Overall I did not find this challenge as hard as others would find it. I just thought of affordable ways to cut cost and how to have quality time with family and friends. The most important lesson was ANYTHING CAN HAPPEN; make sure you have money saved when you have an emergency. So if anyone is looking to take control of their finances and become financially fit just contact me on info@fitnanceiq.com.