Happy holidays everyone. If you have a week off due to Christmas, enjoy. If you’re still working throughout the holidays bless your heart and soul. But I have a question for the folks that celebrate Christmas or Kwanzaa and provide gifts.

Why not have a Christmas club/fund or a sinking fund?!

I received an article the other day from Investopedia about Christmas Club.

Here’s a brief summary if you don’t want want to read it:

“A Christmas club also called a holiday club account, is a type of savings account in which people make routine deposits throughout the year. The accumulated savings are then withdrawn before the holiday season to provide funds for holiday shopping and other expenses, like travel.”

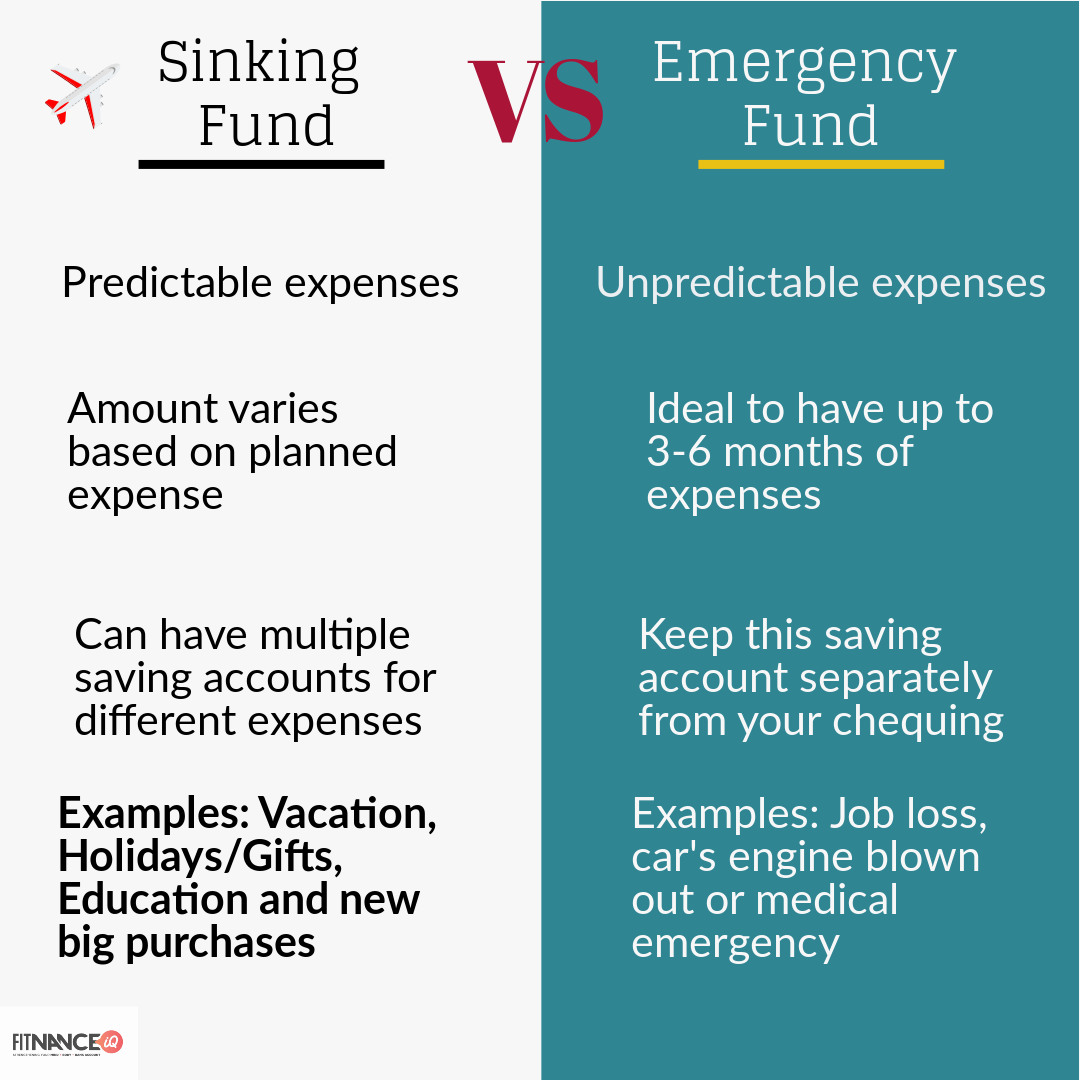

This could be considered similar to a sinking fund:

“ A sinking fund is simply a strategic way to save money by setting aside a little bit each month for future expenses.”

Well isn’t it like an emergency fund?

No, here’s the difference:

Well, what’s the point?

Well for one; you no longer will be frantic when it’s Christmas, your family or friend’s birthday or even the annual vacation you go on. (Once everything is back to “normal”) Doing an extra job just to get by to pay for these gifts! (Imagine using that extra money for investments). Also, You can think of a reasonable amount of money you want to set aside for these expenses in advance. And third, if push comes to shove you can use this money to pay a debt or bill off.

At the end of the day, we know each year what amount we may spend on Christmas. Why not start now. If you won’t consider a Christmas fund think of other sinking funds or clubs such as:

Image by Clever girl finance

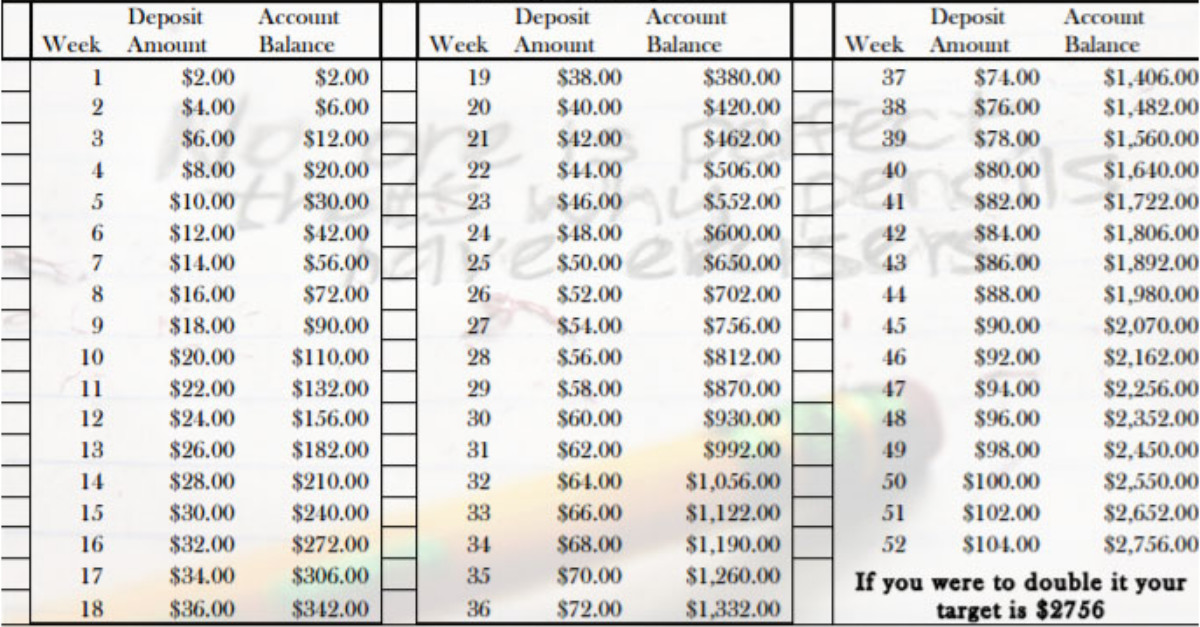

If you’ve followed me for a while you would know about the savings challenge I normally do each year. If you are unfamiliar with the 52-week savings challenge. Check it out here!!

If you need help with getting things set up, feel free to contact me at info@fitnanceiq.com