Welcome back FitnanceIQ family!

First and foremost, to everyone that has been following me for the month of December, I’ve been reintroducing old blog posts to remind you guys what FitnanceIQ Services is all about.

So FitnanceIQ Services focuses mostly on personal finance aspects, such as budgeting, savings and personal taxes and we help small businesses with bookkeeping and self-employed taxes. But let’s drive into the main topic.

CERB known as Canada Emergency Response Benefit has been the talk of the town for most of 2020, especially if you had lost your job or work hours were reduced drastically. So I’m going to give a rundown of what happened.

Jan-Feb 2020 – We were hearing news about Coronavirus aka Covid-19 forming in China. But it’s starting to move across the globe. In our mind, well at least it’s not here; until late February.

March 2020 – Covid-19 had reached North America, by mid-March same time as March break the Canadian government had recommended a lockdown, toilet paper was in high demand, everyone was hoarding. Businesses were closing down people were losing jobs left, right and centre (including myself). What options did some people have?! Luckily some individuals had other jobs or a business to keep them afloat, while others drastically needed HELP!

BUT WAIT! THE GOVERNMENT TO THE RESCUE. March 18th the Canadian government announces an 82 billion dollars coronavirus aid package, by then I was trying to inform individuals how to apply for it, straight from the government’s website how to apply and to see if you fit the criteria!

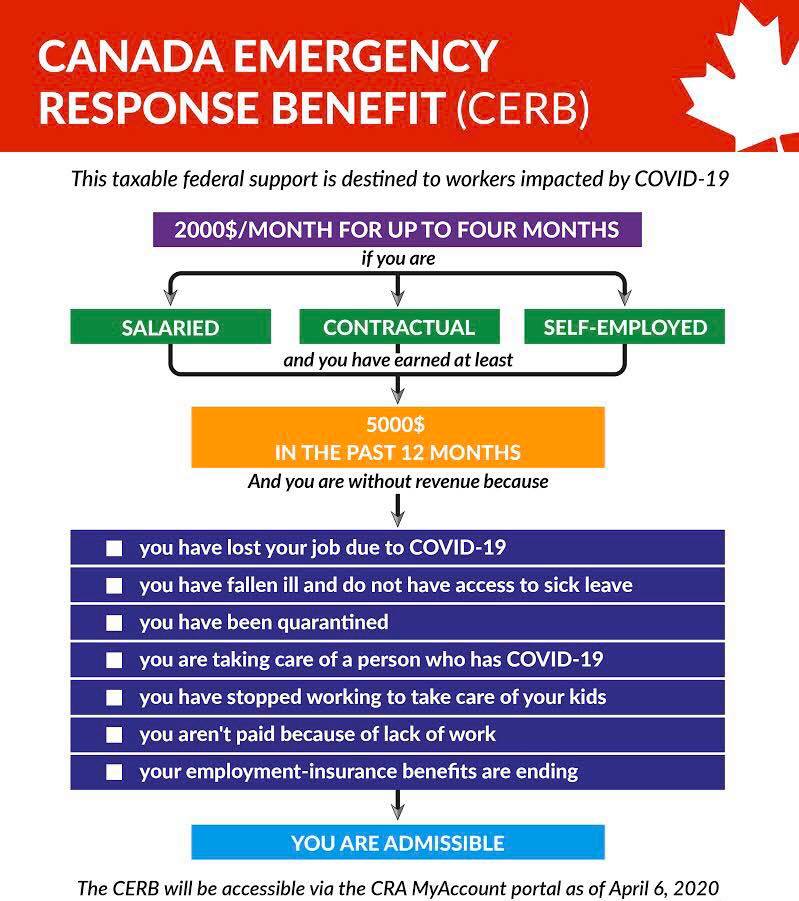

If you were eligible, you would have received $2,000 for a 4-week period (the same as $500 a week). Listen, everyone and their auntie were applying JUST IN CASE. Even if you weren’t considered, individuals were applying for this free money. WAIT, HOLD UP! Who said this was free money?!?! The misconception was that this was free money, no-no-no. This is a TAXABLE INCOME! Meaning Taxable income is the amount of income used to calculate how much tax an individual owes to the government in a given tax year.

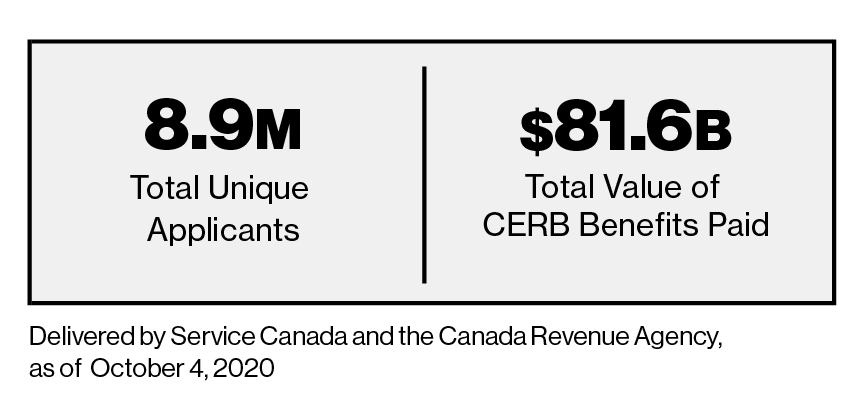

Here are a few stats according to https://www.canada.ca/en/services/benefits/ei/claims-report.html as of Oct. 4th when CERB ended.

– There were a total of 27.57 million applications that were received

– There were a total of 27.56 million application that actually processed

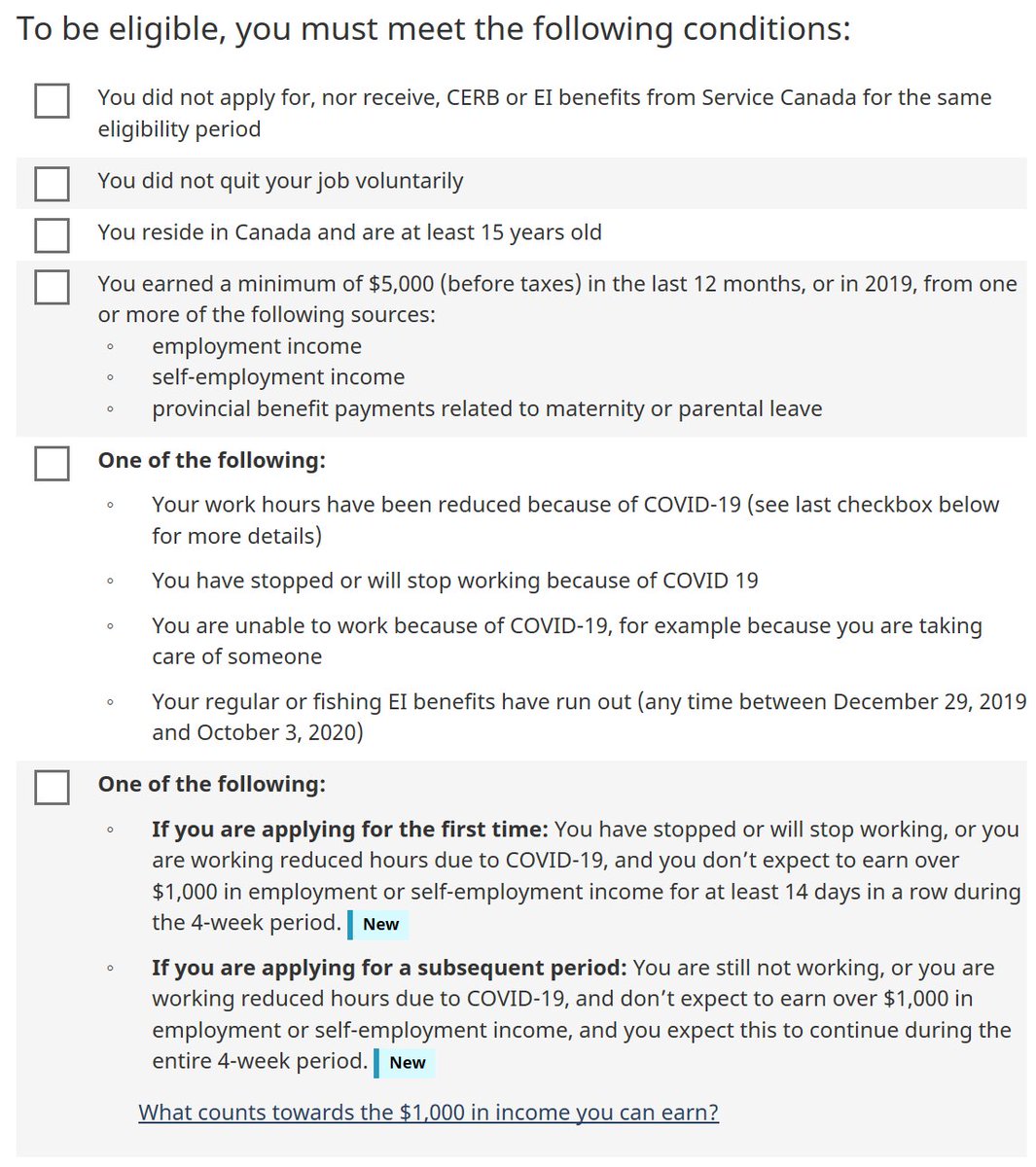

Sounds amazing right?! It is! That the government was able to keep most of us Canadians afloat. However, there were some individuals that misunderstood if they were eligible or not or even applied twice. YIKES. This is for you:

IF YOU RECEIVED CERB AND DON’T FALL UNDER THESE CERTERIAS, PLEASE PAYBACK AS SOON AS POSSIBLE, BEFORE DEC 31ST!

Bonus If you received double payment because you applied through CERB through EI/Service Canada AND CRA website.

To the ones that got CERB twice and didn’t THINK to send back the money and you spent it, the pain you’ll feel when they come back for you. I hope it doesn’t hinder you! I really don’t because I know how hard times can be, but it’s not worth the hassle.

To the ones that thought it was free money, the pain you’ll feel when CRA sends you a T4A. And shockingly will have to pay back. I hope you seek help from a tax specialist or an accountant to plan before the tax season starts.

Okay, that was harsh! Now what? What should I do?

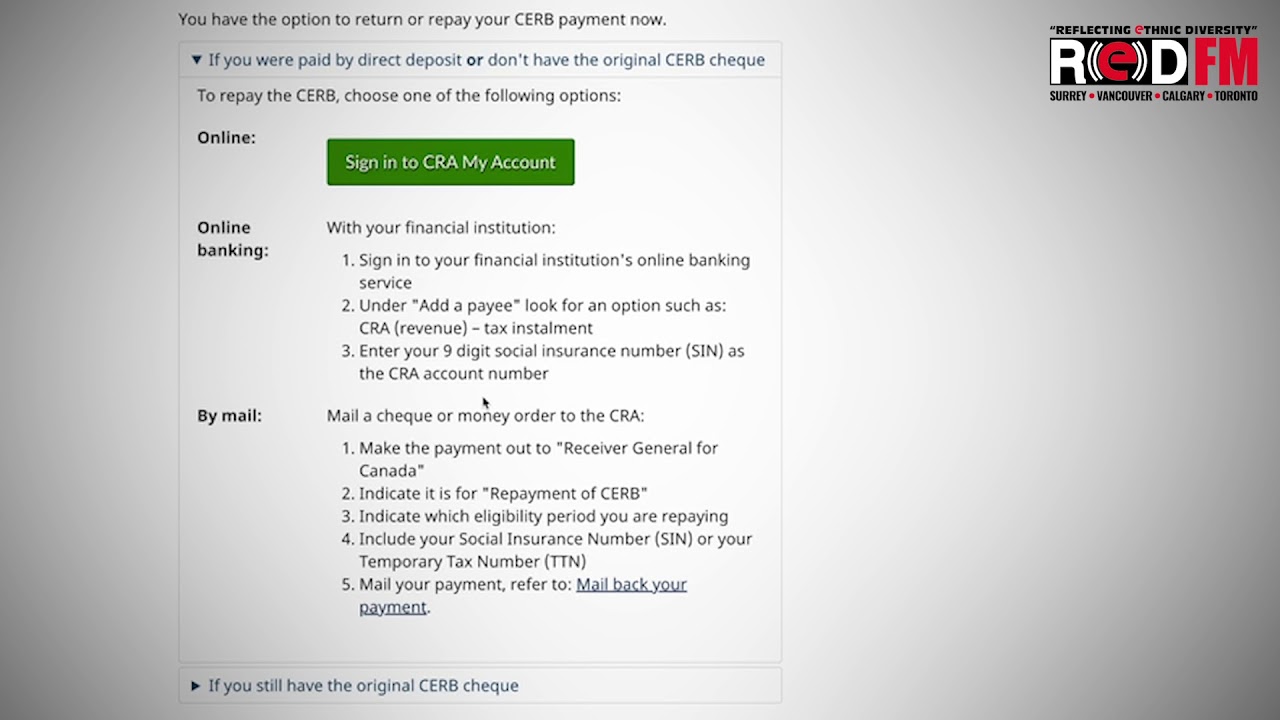

For the ones that weren’t eligible, just pay it back. Why risk paying on interest or losing out on other benefits in the future. It’s not even determining what will happen just as yet. It’s just advised to pay back before December 31st. Let’s be SAFE than SORRY! And here’s how:

For the ones that didn’t realize it was taxable income. It’s TIME TO PLAN!!! Here are some suggestions.

1. Contribute to your RRSP. Even if you consider yourself in the lowest tax bracket, START SAVING! Look at your notice of assessment online or from the letter you received to see how much contribution room you have. Check on this Turbo tax to find out https://turbotax.intuit.ca/tax-resources/canada-rrsp-calculator.jsp

2. Be sure you had done your 2019 taxes. Most likely you are receiving a letter from CRA to send the money back because you haven’t filed your taxes.

3. If you truly strapped for cash, give CRA a call and plan a repayment plan for next year.

It’s been one heck of a year. But you’ll be more stressed next year However, I hope you took the opportunity to find other ways to get over your financial hump and find new opportunities to overcome.

If you have any questions and want to start planning your taxes for the new year feel free to contact me at info@fitnanceiq.com.