Hey FitnanceIQ family!

Last week we were discussing improving your mindset and Dave Ramsey’s baby steps. Which baby step are you currently in? Are you able to combine two baby steps together? Have you reached a moment in your life where you want to actually make a change in your lifestyle? Well if you feel like this, let’s discuss your expenses and how to manage your credit.

How many of us have expenses? I guarantee everyone has expenses whether they are fixed or discretionary or should I say mandatory or optional expenses. How do we manage these expenses? I will always suggest determining out all the expenses you have; which ones are mandatory (needs) and which one are optional (wants). So let’s do an activity, grab a piece of paper, no really, grab one, please. Make a list of your expenses (including the amount) each month, which may include:

- Mortgage/Rent

- Groceries

- Transportation

- Internet

- Cable

- Phone

- Gym membership

- Shopping

- Entertainment

- Medical

- Insurance

- Other Various Expenses

I haven’t mentioned all types of expenses as everyone’s lifestyle varies, so if there are other expenses you know you have, add them. Then comes the hardest part of the activity, being honest and taking the time put M beside your mandatory expenses, aka needs, and O next to your optional expenses, aka wants. If you aren’t sure how to decipher which expenses are mandatory or optional, I will give you a hand. For example, for my lifestyle, a gym membership is mandatory because I often go 3-4 times a week, while cable would be optional because I only watch it once in a while and can watch the show online. So Internet is considered mandatory for me as well.

Great! You figured out your optional expenses. These are the expenses you can put on the back burner and reduce your overall expenses. Is this hard? YES. Is it impossible? Absolutely not!! I’m not telling you to cut your optional expenses off FOREVER, but there can be 2 or 3 expenses that you can be reduced for the time being until you are financially back on track. I want you to think about living within your means and sacrifice for short-term to get in a better position long-term. I had to do that this year, I had to say no to at least three trips and a couple of events so I would be able to pay off my credit card. But I still went to other fun events that were much cheaper. So I say sacrifice for the short-term by reducing your expenses, instead of going completely cold turkey forever, as you will feel resentment towards yourself and probably not stick it out.

Find creative ways to reduce expenses. Here are a few as an example:

- Bring your own lunch and snacks to work

- Make your own coffee at home or bring coffee from home to make at work

- If you get a manicure/pedicure every week or two weeks, reduce to once a month and do it yourself at home in between

- Instead of going to happy hour every Thursday night for Thursday night football, try to have a potluck (with affordable food and drinks) at your place

- Do you have a coworker or family member that lives or works by you? Try carpooling!

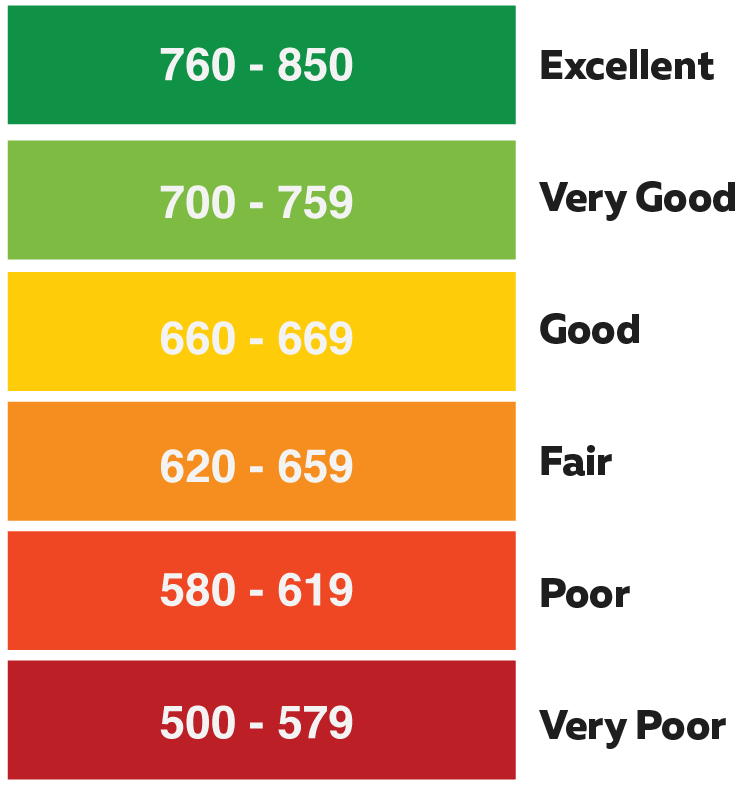

Financial well-being is not limited to minimizing expenses but also includes having a good credit score. Have you ever thought about your credit score? Are you aware that certain jobs or home rentals won’t accept you if you have a low credit score (300-450)? If you don’t know what a credit score is, according to MyMoneycoach.ca, “Your credit score is a number, based on specific information on your credit report. Your credit score is used by lenders to predict the likelihood that you will repay future debt.”

Some of the debts or ongoing payments (payments made on time) that impact your credit score are:

- Mortgages (not reflected on credit report)

- Car loans

- Credit card balances

- Line of credit balances

- Payday loans

- Taxes you owe

- Buy-now-pay-later balances

- Unpaid utility bills (cell phone, hydro, cable, etc.)

- Student loans

- Spousal support and/or child support you owe

These are going to play a factor in how your credit score is rated. Keep in mind, to win in this game you don’t want to have all of these under your belt. If you do, you want to keep them in good standing to the best of your ability. Some of these may be in your optional expenses, so be cautious.

Now that you have an idea of what would be on a credit report, let’s see how your score is determined. Here are the five factors used to score you according to MyMoneyCoach.ca:

Payment history (35%)

Your payment history is the most important factor in your credit score. Creditors want to know if you are going to pay them back the money you are asking to borrow from them. You want to show that you will be in good standing with your debt. Your credit report will show if you have any past due payments, how often your payments have been late or even if you filed for bankruptcy.

Tip: Concentrate on making your payments on time. PLEASE! Try not to accumulate more debt. If you honestly can’t afford it, DON’T GET IT!

How much is owed (30%)

When you apply for credit, how much you already owe really matters to a lender. Your current payments will determine if you can manage any more payments in your budget for the additional money you borrow. Have you been paying off your debt gradually and noticed your credit card upgrades your credit limit? This is normally the case when you are at least below 35% of your limit. They figure if you can manage to keep it below that, you will be able to handle more credit.

Tip: You want to keep the money you owe LOW, preferably 35% or less of your limit.

Length of credit history (15%)

If you have had credit available to you for a long time, your credit report should provide an accurate picture of how you use credit and if you had one, how you got through a difficult time. For someone who has not used credit for very long time, it is difficult to tell if they really know how to use credit responsibly. Keep this in mind, the longer you have a credit card the better it is on your score, but you have to keep it in good standing, remember!! If you just got a credit card, your credit score won’t be as strong as someone that has had it for 2+ years.

Tip: Paid off that credit card that you’ve had for years? Awesome! BUT WAIT, don’t cancel that card just yet. It will actually lower your credit score.

New credit applications (10%)

Frequently applying for a new credit card can signal financial difficulty. In the industry it’s called “credit shopping” and it does not reflect favourably on someone’s credit score. Have you been trying to get different types of debt (see above)? Be careful! This will trigger a red flag for some creditors. It shows that you may not be able to pay it back if you’re getting into more debt.

Tip: Instead of getting more debt, IF possible, ask a family or friend (and please pay them back within a timely matter).

Types of credit used (10%)

Even though this part of your credit score makes up 10% of the total, it is the least significant part, unless you don’t have much other information on your credit report. Even though it’s not as important, it’s a factor that will still affect you. Like I mentioned before, just don’t try to have all the debts under your belt. It will show that you are not able to manage your finances wisely.

Tip: Keep the basic credits; it’s normal to have student loans, car loans, credit cards or even line of credit. Try to have at least two of those at a time. Ideally, you don’t want ANY debt though.

I didn’t really get into it, but remember that things like late payments, getting into collection and filing for bankruptcy IMPACTS YOUR CREDIT SCORE DRASTICALLY! I 100% don’t believe in Debt Consolidations, but if you really struggle and you’re in desperate needs, it is a consideration. Or like I said in the beginning, you have to start eliminating expenses to get back in shape financially.

I know this is a lot of information to digest but these are things that are HIGHLY important! Without sorting out your expenses, it’s difficult to build wealth! So the most important thing is seeing where your money goes. Are there some expenses you can reduce at the moment? Are you concerned about your credit score? Did you know that you can check your credit score for free once a year (Perhaps going with Equifax isn’t the smartest idea right now though)? If you have any questions please feel free to ask me. Remember the goal is to become LEADERS and be financially fit. Much love to you guys.