Hi ladies and gentlemen, we are almost at the end of February. I’m sure we have learned something during Black History Month, embraced Valentine’s day or completely ignored it, enjoyed watching Black Panther make movie history and the number sports so far (Superbowl, South Korea Olympics {BIG UP} and All-star weekend). Nonetheless, I’m not here to discuss those; I’m here to talk about TAXES.

Last year, I spoke about whether putting money towards RRSP is beneficial or not. Check it out; the rules haven’t really changed this year. Normally I write a blog further into tax season, but I felt like I needed to advise before the majority of people started spending.

I know the moment individuals get their tax refund, their eyes open up WIDE they are thinking of the new wardrobe they can get, the vacation they have been dreaming about. SOME neglect that consumer debt that they are in, neglect the emergency saving that is currently at $0 or not even $100 or even considering getting a loan for their education. WWWWAAIIITTTT!!! Before you think of spending your tax return, take in these considerations.

Pay off that long dreadful debt

Consumer debt! (Shivers) Most of us have it and put it on the back burner. The average Canadian owes at least $8,500 in consumer debt and this doesn’t include the mortgage. However, there’s hope at least for 46% of Canadians, which don’t have consumer debt.[1] So wouldn’t you like to be part of that group? I know I do, so if you already have a debt repayment plan; why not slim it down a couple months by putting a lump sum of your tax return in it. Last year, I managed to use part of my tax return to pay off the rest of my student loans and part of my credit card. I rather have a positive net worth than negative net worth.

Put some money towards your emergency savings fund

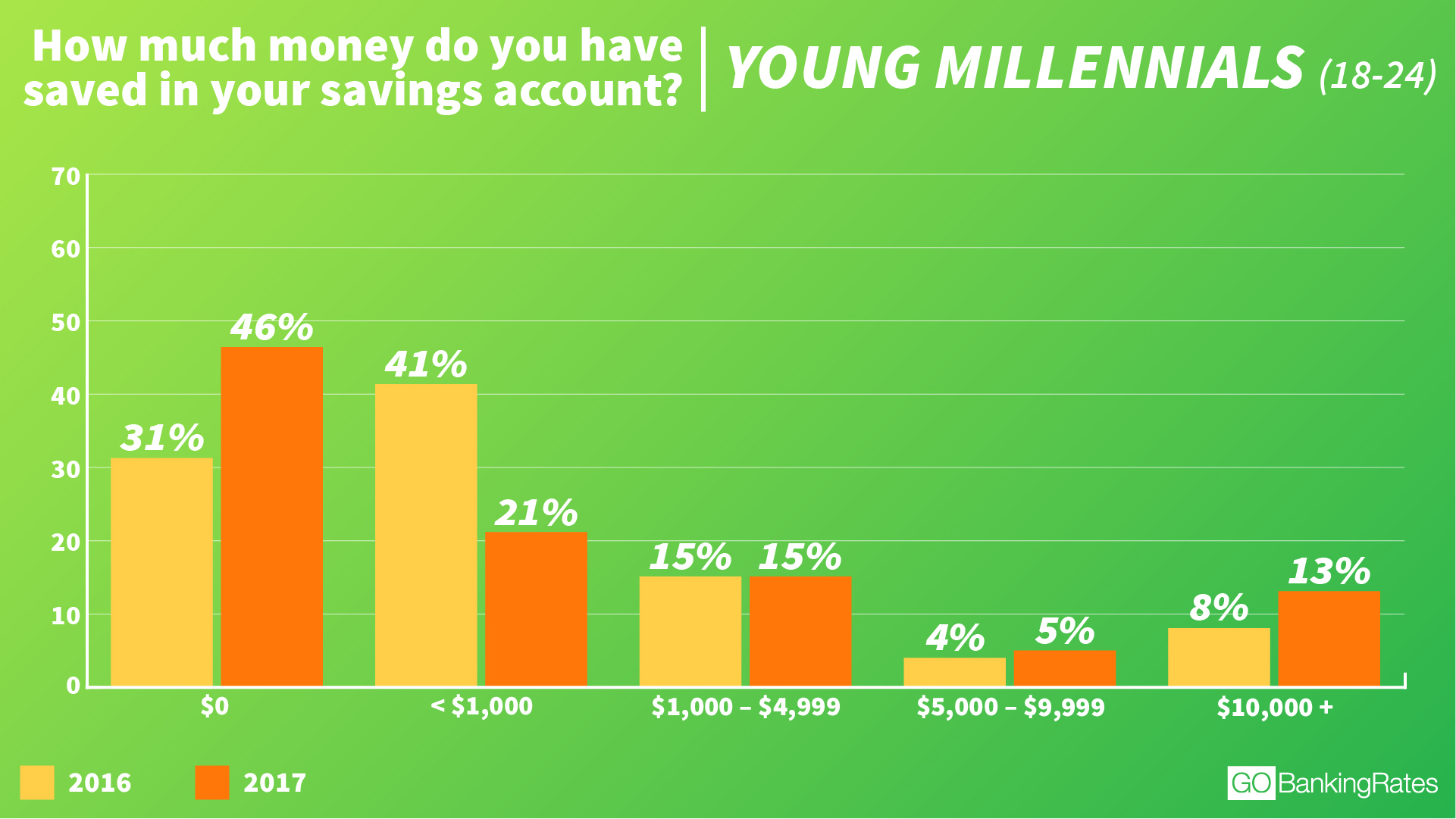

There are two studies that show that 37% of Canadians aren’t able to save and 46% of Americans have $0 in savings.[2][3]

This was quite scary to me, because as we all know “$@^# happens” in life, it’s always good to have a safety cushion instead of depending on credit cards or payday loans to get you stuck in more debt. If you like you can have different types of savings for yourself such as:

- Your “ah sh!t” fund (I’ve experienced a lot of these lately, so decided to switch it to that instead of “emergency”)

- “Treat yo’ self” fund ( treat yourself at least once a month, so you can still feel sane in life)

- “financial freedom” fund (discussed in the next method)

As long as you start putting yourself first and give your lovely savings some compound interest. You will thank yourself 5 years from now (I know I did). So if you don’t want to put ALL of it into savings that’s fine, try to put a good amount in so you will see it grow gradually.

Put the money towards your long-term financial goals (retirement and investment)

When it comes to thinking of our retirement, it’s usually in the back of our head. Most individuals are thinking about RIGHT NOW or the next 3-6 months; forget what will happen in the next 20-30 years. Have you ever thought about the money decisions you made in the past and wish you done better? Hey, it’s not too late!! You can start now. Maybe you have already started and haven’t even realized; does your company do employer RRSP contribution? Awesome! If they don’t, it’s okay you can start your own RRSP if you are concerned about that or think of a TFSA this can be for your emergency funds that I mentioned previously. Once again use a financial freedom fund, which could be considered anything really but just think of it as your “free from doing a 9-5 forever” fund.

With regards to investing, at least half of Canadians don’t have investments and at least 60% that don’t invest don’t understand enough about investing to get started.[4] This is where uncertainty comes into play; I would suggest a couple of things

- start looking at investopedia.com to educate yourself and try a “stimulator” account

- Ask a family, friends or a mentor if they have done investments

- Start listening to podcast, watching YouTube or reading books about investing

- Check to see if you are actually investing in your company

- Get a consultation with a CFP or investment broker (make sure you find one that actually is looking out for your best interest)

If you want to start with 10-20% towards your retirement; go for it! Just remember this is an account that you plan not to touch for 10-20 years from now. Keep it separate from your short-term goals and emergency fund.

Put it towards a business (or putting it back into your business)

Have you been thinking of a business for the longest time, but didn’t have the funds for it? Are you in a business at the moment and need to invest back into your business for it to flourish? Well, your tax return is your best bet, talk about really investing in yourself. This can even be educational steps to improving your business or getting a certain designation or degree. Remember this is once again another expense you can claim for next year. To the freelancers or self-employed or about to be, I would really consider this one. (Low key this may be the number one for me!!!)

Put the money towards your short-term goals (vacation, investment, car/housing)

Ha! I bet y’all didn’t think I would mention this! Now let’s be honest, I consider myself a very understanding individual because I am human as well. I have some short-term goals that are able to keep me sane and I see it as rewarding myself for having self-control. Last 6 years I LIVED for travelling, anytime someone would tell me they were about to go on a trip. I would bust my arse to be able to go, and I love my memories and experiences. However, I’m now at a stage where I rather be a bit more financially stable before treating myself, I hope you can feel the same way too. Last year I had said “no” to numerous travels, I learnt self-control and remember my ultimate financial goals! I’m planning on going somewhere in the near future. It will be once I’m fully comfortable leaving for a week (or two—a sista can dream) without my world crumbling around me.

At the end of the day, it’s your choice on how you will spend your money. However, let me ask you this? The instant gratification you feel now, will you feel the same way about it by the end of the year or would you had wished you actually consider options that will make you financially stable in the long run. Until next time ladies & gents.

Reference

[1] https://globalnews.ca/news/3933617/average-canadian-consumer-debt-ipsos-poll/

[2]https://ca.finance.yahoo.com/news/growing-percentage-millennials-nothing-saved-133000049.html

[3] https://www.investmentexecutive.com/news/industry-news/generations-struggle-to-save-for-retirement/

[4] https://www.getsmarteraboutmoney.ca/resources/publications/research/missing-out-millennials-and-the-markets/